Income tax law describes apportionment of deductions. Sales of patent rights.

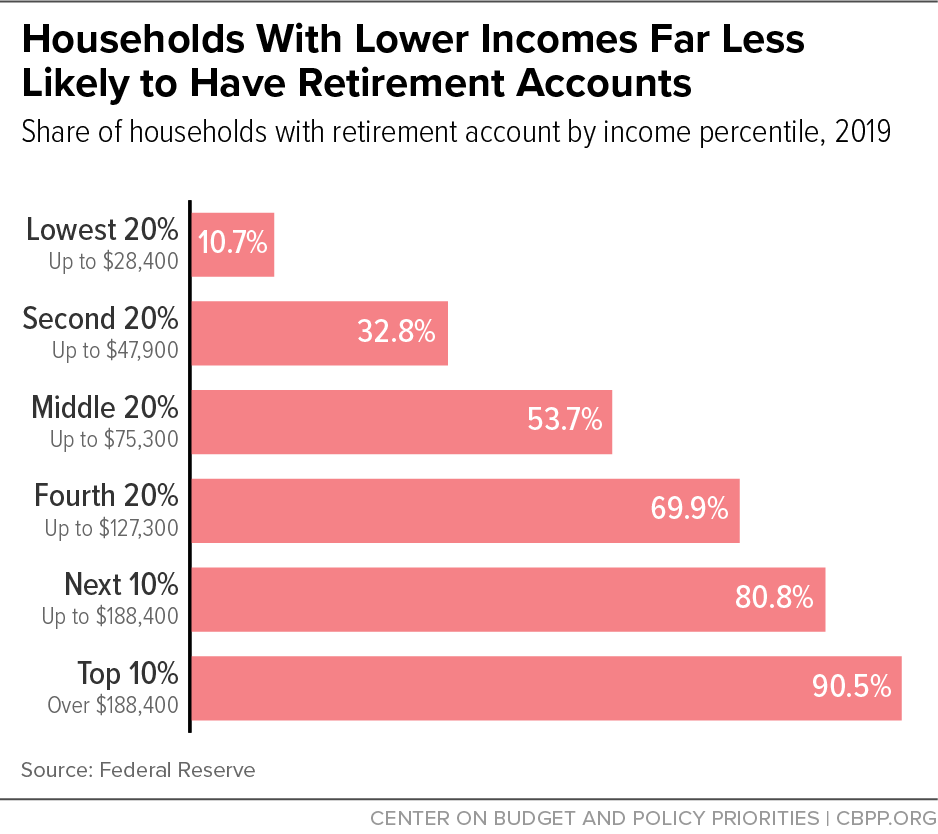

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Yet another development that took place after the search operation was that by an order dated 26062013 passed under Section 127 of the Act the Commissioner of Income Tax Central Ludhiana centralized the cases of the Assessee for the assessment years 2006-07 to 2013-14 and transferred the same to Central Circle Ghaziabad.

. Therefore not subject to withholding under the Foreign Investment in Real Property Tax Act FIRPTA. 332 RE 2019 9 _____ CHAPTER 332 _____ THE INCOME TAX ACT An Act to make provisions for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for matters incidental thereto. Income tax calculation on fair market value.

The Income Tax Department NEVER asks for your PIN numbers. How to make appeal before commissioner IR. Post getting recognition a Startup may apply for Tax exemption under section 80 IAC of the Income Tax Act.

Return of interest paid Omitted. Income charged under section 587. Income Tax Act 2007 is up to date with all changes known to be in force on or before 09 September 2022.

The Income Tax Act CAP. Offences by corporate bodies. 2 - DIVISION A - Liability for Tax.

As laid down in the Notification No. Tax rates for individuals estates and trusts for taxable years after 1994. INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Short title and commencement 2. Person liable for tax under section. Tax year in which certain expenditure treated as incurred.

Subtitle B Extensions through 2019 Section 141. Loading of goods destined for export on foreign-going vessels and aircraft and cross-border railway carriages114. Board means the Income Tax Appeal Board appointed under.

Furnishing of statement of financial transaction. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules 12 - Inclusions 18 - Deductions 22 - Ceasing. Income Tax 7 Issue 1 Section 116.

Income Tax Act No. 1 - Short Title. Income Tax Case Laws Section Wise containing decisions of Supreme Court High Court Tribaul CESTAT CEGAT AAR Advance Ruling Authority etc.

Post getting clearance for Tax exemption. Compilation of Social Security Laws 1903. Orders permissible following conviction of person of offence contemplated in section 2 2.

2 - PART I - Income Tax. Application of Information Technology. UK furnished holiday lettings business treated as trade.

Form of notices returns etc. Officer may appear on prosecution. Computation of Fair Market Value of Capital Assets for the purposes of section 50B of the Income-tax Act.

In this Act unless the context otherwise requires basis year means the calendar year coinciding with the year of assessment except where another period is substituted by the Commissioner under section7of this Act. A For taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550 computed at the following rates with the income. Section 199 the new markets tax credit and the orphan drug credit.

Exceptions to charge under section 583. Procedure for Commissioner Appeals in proceeding. The House Tax Cuts and Jobs Act would reform both individual income tax and corporate income taxes and would move the United States to a territorial system of business taxation.

Service of notice summons requisition order and other communication. Charge to tax on income from disposals of know-how. Cessation of exemption 128.

This Act may be cited as the Income and Business Tax Act. --Sales Tax Act 1990 Updated up to June 30 2021--Tax Laws Third Amendment. 11 of 2004 15 of 2004 13 of 2005 6 of 2006 16 of 2007 1 of 2008 13 of 2008 14 of.

The provision authorizes the allocation of 35 billion of new markets tax credits for each year from 2015 through 2019. There are changes that may be brought into force at a future date. Charge to tax on income from sales of patent rights.

Service of notice summons requisition order and other communication. List of sections or provisions. C for the purposes of applying sections 37 65 to 664 667 111 and 126 subsections 1275 to 36 and section 1273 to the person the person is deemed to be a new corporation or trust.

127 E dated 19022019 issued by Department for Promotion of Industry and Internal Trade DPIITthe following will be considered as a Startup -. 3 - DIVISION B - Computation of Income. This Act may be cited as the Income Tax Act 1973 and shall subject to the Sixth Schedule come into operation on 1st January 1974 and apply to.

1396b From the sums appropriated therefor the Secretary except as otherwise provided in this section shall pay to each State which has a plan approved under this title for each quarter beginning with the quarter commencing January 1 1966an amount equal to the Federal. Income charged under section 583. Of sub-section 1 of section 48 of the Income-tax Act 1961.

Person liable for tax under section 583. Extension of new markets tax credit.

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

Format Procedure And Guidelines For Submission Of Statement Of Financial Transactions Sft For Interest Income Guidelines Income Taxact

Learn How Your Family Can Help You Save Taxes

Claim Income Tax Rebate Under Section 87a For Fy2021 22 Ay2022 23

How To Track Gst Registration Application Status In Overview Status Application Pre And Post

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Tax Delinquent Property And Land Sales Alabama Department Of Revenue In 2022 Scholarships Guidance Acting

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Pin On Bankruptcy Infographics

Landmark Judgment Section 40 A I And Ia Provides For Disallowance Only In Respect Of Expenditure Which Is Revenue In Nature How To Apply Judgment Revenue

Section 10 Of Income Tax Act Exempted Income Under Section 10

Preparing Tax Returns For Inmates The Cpa Journal

Fake Transcripts High School Transcript Amazon Promo Codes University Student

Clarification Regarding Gst Rate On Laterals Parts Of Sprinklers Or Drip Irrigation System Drip Irrigation System Irrigation System Irrigation

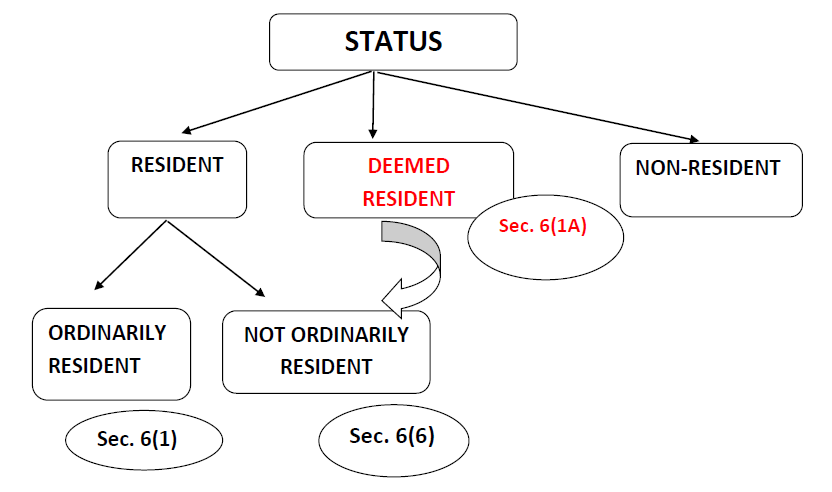

Nri Status For Financial Year 2020 21 New Circulars Sbnri

Solution For Dsc Trouble Shooting On Gst Website Https Taxguru In Goods And Service Tax Solution Dsc Trouble S Solutions Goods And Service Tax Indirect Tax

Income Tax Income Tax Income Tax